The blockchain is generally associated with Bitcoin and other cryptocurrencies, but these are only the tip of the iceberg. And it is that this technology, which has its origins in 1991, when Stuart Haber and W. Scott Stornetta described the first work on a chain of cryptographically secured blocks, was not noticeable until 2008 when it became popular with the arrival of bitcoin.

But currently, its use is being demanded in other commercial applications, and annual growth of 51% is projected by 2022 in several markets, such as financial institutions or the Internet of Things (IoT), according to MarketWatch.

Blockchain: What does it mean?

In short, the blockchain is a distributed database system where all transactions are recorded chronologically and publicly available for everyone to see. This means that no one can modify them without leaving traces behind. The main advantage of using blockchains is their transparency; they allow anyone who wants to verify any transaction to do so at any time. They also provide an immutable record of every single event in history.

The first application of this technology was Bitcoin, which uses a public ledger called “blockchain” as its backbone. It allows users to send money directly from one person to another with very low fees compared to traditional payment systems like credit cards or PayPal. However, many other applications have been developed on top of the original concept, such as Ethereum, Ripple, Litecoin, etc.

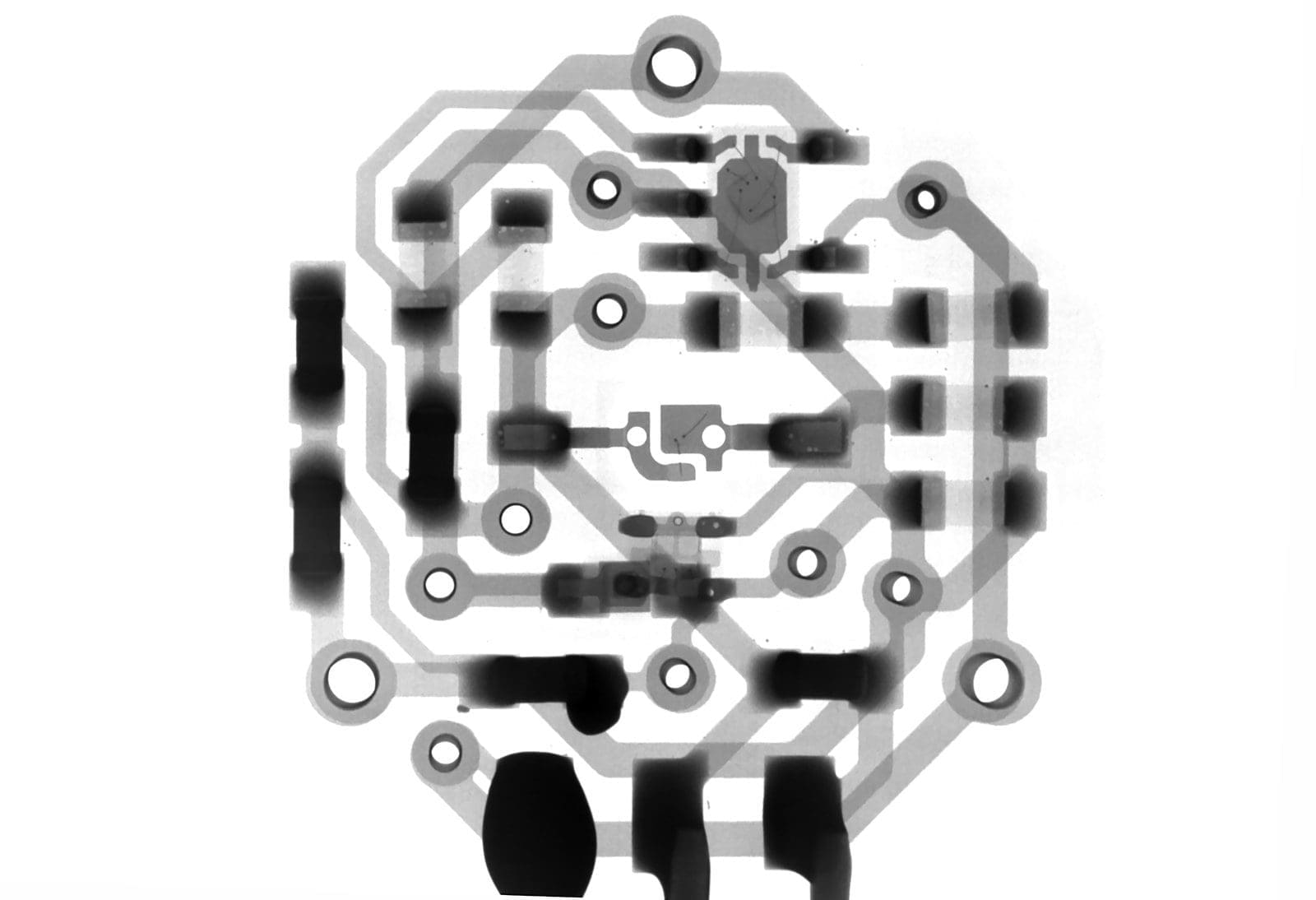

How Blockchain works

A blockchain consists of two parts: A set of records known as blocks, each containing information about previous blocks, and a mechanism for validating new blocks against existing ones. Each block has a cryptographic hash value of the data contained within it. In addition, each block includes a timestamp indicating when it was created. When users create a new block, they must include a reference back to the previous block to prove that their block follows logically after the last one.

Thus, if someone tries to change the content of a particular block, they will be able to identify themselves because their changes would result in a different hash code than what existed before.

This process makes sure that the entire network knows precisely how old each block is and, therefore, whether it should trust it or not. If you want to learn more about the technical aspects of blockchains, check out oschain.io.

Why do we need blockchain now?

There are three reasons why companies around the world are starting to adopt blockchain technologies today:

Transparency

Transparency is essential for businesses because it helps customers feel confident knowing that everything is done honestly. For example, if I buy something online, I expect my bank account balance to reflect accurately what has happened during the purchase. However, with blockchain-based platforms, I am assured that the company I bought from did indeed receive the funds and that those were used only for the intended purpose.

Security

Blockchains make security easier to achieve since they eliminate intermediaries and third parties. For example, instead of relying on banks or governments to keep track of your finances, you can simply store your private keys yourself. You don’t even need to worry about hackers stealing your personal details either since nobody, but you hold access to your wallet.

Speed

Since blockchains are decentralized networks, they operate much faster than centralized databases. Transactions take place almost instantly, while most centralized services require multiple steps to complete a task. Moreover, since blockchains are open source, developers can easily add features to improve performance.

How does blockchain work?

Public Ledger

Each node on the network has access to an identical copy of the entire history of every single transaction ever made by users across the whole network. In addition, each user’s account balance is stored with every node on the network. So if you want to know how much money someone has deposited into your bank account, you need only ask the nodes connected to your bank.

Likewise, if you tried to withdraw funds from your account, you simply send a request to those same nodes asking them to transfer the amount back out of yours. All these requests are broadcasted over the network simultaneously, making sure that nobody gets paid twice for the same service. This process ensures transparency and trust among all participants.

Nodes

The second component of any blockchain system is the set of computers known as “nodes.”These nodes store copies of the data shared within the network and act as gatekeepers to prevent unauthorized transactions. They verify new blocks, add them to their local database, and distribute rewards based on the number of confirmations they have received. As long as at least one node agrees with the information contained in a given block, it becomes part of the permanent record of the blockchain.

Smart Contracts

The third component of any blockchain system includes smart contracts. These self-executing programs run precisely according to preprogrammed rules without human intervention.

For example, when somebody deposits money into their wallet, the contract specifies what should happen next. It might tell the recipient to pay another party immediately or wait until later. Or maybe it advises both parties to deposit additional amounts so that the total sum remains unchanged. When the conditions specified in the contract are met, the program executes accordingly.

Let’s say Alice sends Bob $100 worth of bitcoins through a peer-to-peer platform. First, she generates a unique address for her coins. Then, she signs off on the transfer using digital signatures. Finally, she broadcasts these messages across the internet to ensure that everybody sees the same thing.

Once this happens, Bob receives the money and stores it safely inside an encrypted file called a “wallet.” He then uses the public key associated with the address generated by Alice to sign off on the transaction. Now, whenever anybody needs to send him some bitcoin, he checks the signature attached to the message and verifies its validity. Since nothing is stored centrally, neither Bob nor anybody else can steal the money once it leaves Alice’s computer.

The beauty of blockchains is that every person involved in the transaction gets paid automatically as soon as the payment goes through. There is no need for intermediaries like banks or credit card processors. All payments happen directly between two people, which eliminates fraud and reduces costs significantly.

Blockchain vs. Bitcoin

Bitcoin was invented in 2008 by Satoshi Nakamoto, but its concept dates back even further than that. Blockchain technology can be traced back to 1991 when Australian cryptographer David Chaum published “Eve,” which described a decentralized electronic cash system. Although this idea never took off, he did manage to create something called DigiCash, which used cryptography to allow people to make secure online purchases.

In 1994, Nick Szabo created bit gold, a digital currency similar to bitcoin. He proposed using cryptographic proof instead of physical coins to ensure ownership rights. His proposal would eventually become Ethereum.

The first successful cryptocurrency was released in 2009 under the name ripple. Its creator, Chris Larsen, had been working on a project called OpenBazaar since 2007. Ripple’s main innovation was distributed consensus through a peer-to-peer network rather than relying on central authorities like banks do today.

Who benefits from blockchain technology?

The most obvious beneficiaries would be banks or financial institutions, which could use this technology to improve efficiency in areas such as cross-border payments, trade finance, asset management, insurance claims processing, etc.

However, many other industries will also benefit from its implementation, including healthcare, supply chain logistics, energy trading, real estate, government services, education, manufacturing, retailing, transportation, media & entertainment, gaming, and more.

Be the first to comment