Last year was a really challenging one. Covid-19 was still causing panic all over the world with its mutating variants. This made governments and the world health organization reluctant to ease up on the restrictions despite the development of vaccines. This greatly hindered the running of businesses.

Therefore, things were still bad for everyone financially. The gradual ease-up did not brighten the situation as financial responsibilities had to be undertaken on a constrained budget. Breadwinners of families are under a lot of pressure and some are resorting to unhealthy measures. This article is a guide on how to fix this situation by reducing your household expenditure in 2022 and alleviating some of this pressure.

Use Quality Home Appliances

Yearly, a lot of money is spent in the repair of home appliances. These appliances are vital to the daily operations of the house, we simply cannot make do without them. They include cookers, refrigerators and air conditioners among others. When they spoil we will be forced to order food from restaurants and take other measures.

Yearly, a lot of money is spent in the repair of home appliances. These appliances are vital to the daily operations of the house, we simply cannot make do without them. They include cookers, refrigerators and air conditioners among others. When they spoil we will be forced to order food from restaurants and take other measures.

This is not a viable solution due to the huge costs involved and you will have to repair these appliances. The repairs are costly and will certainly snip a hefty sum from your expenses. You can prevent this from the start by buying quality appliances through a China sourcing agent that will not require regular repairs.

Embrace Conservation

We spend a substantial amount of money on utility bills every month. Add up the yearly expenses and the sheer sum will be astounding. This should not be the case, these bills could reduce drastically if we use these resources properly. Practicing conservation will help you save a lot of money.

We spend a substantial amount of money on utility bills every month. Add up the yearly expenses and the sheer sum will be astounding. This should not be the case, these bills could reduce drastically if we use these resources properly. Practicing conservation will help you save a lot of money.

Instead of using incandescent or fluorescent lighting use LED lights as they have been proven to consume much less energy. There are various LED light wholesale retailers that can provide you with many affordable lighting options. Ensure the members of your household turn off the taps and use water sparingly. Also, discourage using running water and your monthly water bill will reduce.

Keep Your Family Healthy

Health and well-being of your household is a very important thing. The amount of money used in the treatment of cancer, kidney failure, heart conditions and other serious health conditions is staggering. A chemotherapy session or a dialysis costs a substantial amount. Of course we cannot sit by while our loved ones are suffering, we will resort to money budgeted for other expenses and increase the expenditure.

Health and well-being of your household is a very important thing. The amount of money used in the treatment of cancer, kidney failure, heart conditions and other serious health conditions is staggering. A chemotherapy session or a dialysis costs a substantial amount. Of course we cannot sit by while our loved ones are suffering, we will resort to money budgeted for other expenses and increase the expenditure.

As a precaution, take measures to reduce the prospect of any household member getting these diseases. Ensure they go for regular health checkups, eat healthy and exercise regularly. You can also take an affordable health insurance premium cover for your whole family. This will be very helpful incase of a medical emergency.

Budget Well

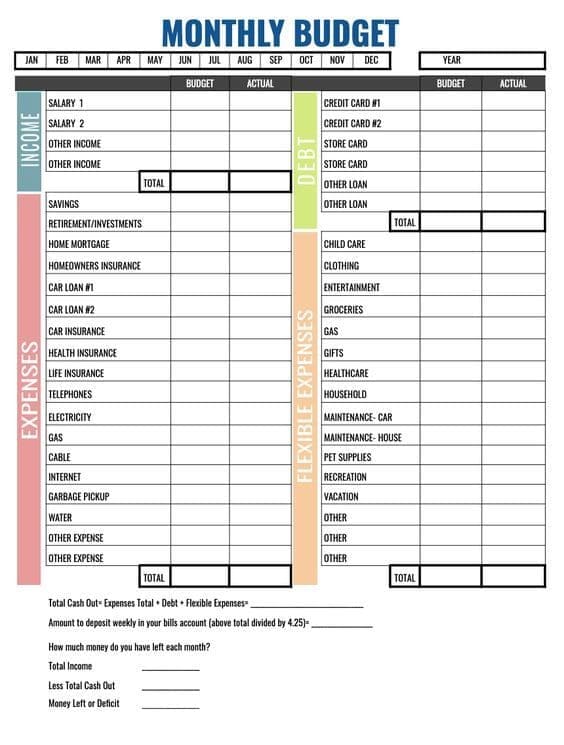

There are many expenses to be handled in a household within a month let alone a year. So managing this many expenses appropriately can be very tasking on you. This is where budgeting comes in. A proper budget will help you plan for the expenses with ease.

There are many expenses to be handled in a household within a month let alone a year. So managing this many expenses appropriately can be very tasking on you. This is where budgeting comes in. A proper budget will help you plan for the expenses with ease.

So carry out an internal audit of your finances and use the result to draw a budget. Allocate an approximate amount to each expense and establish the state of your finances thereafter. Budgeting is not a mere ceremonial process so ensure you adhere to it if you want to cut your household expenditure.

Cut Of Unnecessary Spending

Thrifty spending cannot help in the expenditure reduction cause. Shopping for luxurious items on a tight budget is not sensible. Avoid any unnecessary spending in order to reduce your expenses. Lay off from shopping for a while, buy only the necessities.

Thrifty spending cannot help in the expenditure reduction cause. Shopping for luxurious items on a tight budget is not sensible. Avoid any unnecessary spending in order to reduce your expenses. Lay off from shopping for a while, buy only the necessities.

In fact, stay away from clothing stores and the likes if the temptation grows. Do not replace the comfortable wholesale plastic chair on your lawn with an expensive chaise. Keep the money somewhere, even a locked savings account and you can use it later on for a worthy cause.

Relocate

This may seem like a rather harsh move, uprooting your family from a familiar location and settling them elsewhere. But difficult situations usually force us to react unpleasantly. If you live in an upscale location where rent rates, prices of commodities, and even schools are expensive. Downgrade to an affordable area for the time being until things get back on track.

This may seem like a rather harsh move, uprooting your family from a familiar location and settling them elsewhere. But difficult situations usually force us to react unpleasantly. If you live in an upscale location where rent rates, prices of commodities, and even schools are expensive. Downgrade to an affordable area for the time being until things get back on track.

Conclusion

Many of us are in a bad state financially. This situation can be overwhelming for most of us. We end up getting depressed because we cannot provide for those who depend on us. This article provides us with a way out of this financial hole. It guides us on how we can reduce our household expenses and save up for other things.

Be the first to comment