With the multitude of mutual funds (MFs) available to investors today, choosing the right fund can be a tough task. Even before you start picking, you need to decide whether you want to invest in Equity or Debt Funds. We shall be looking at the key differences and how you can go about choosing between the two types.

Debt Funds

These are low-risk MFs that put the investor’s money in securities like corporate bonds, government securities, treasury bills, commercial paper, and other money market instruments. The primary aim of debt funds includes capital protection and generating regular income.

Equity Funds

MFs that invest your money primarily in equity shares or equity-linked securities are called equity funds. Although higher in risk due to the volatile nature of equity securities, which are dependent on micro and macroeconomic factors, they have the potential to generate higher returns than debt funds. Investors looking to build wealth over the long term usually invest in equity funds. Over the long run, equity as an asset class has the potential to beat inflation and compound at higher rates than other investment products, leading to wealth creation.

Key differences between Debt and Equity Funds

- Nature of the Fund: Debt funds invest in fixed income instruments like government and corporate bonds, non-convertible debentures, etc., while equity funds invest in stocks and equity-linked securities. Debt funds, with their higher certainty of return, are recommended for investors looking for capital protection and a steady income from their investments. Equity funds are a better option for growth and wealth creation.

- Risk and Returns: Investing primarily in stocks, equity funds are regarded as riskier of the two, being volatile in nature and susceptible to macro-economic factors like tax rates, inflation, currency fluctuations, etc. Debt funds, on the other hand, are comparatively safer as they invest in risk-free government securities, rated debt securities, and money market instruments. In the case of equity funds, any change in the market prices of equity securities invested in will impact the Net Asset Value (NAV) of the fund. The NAV of debt funds is impacted by changes in interest rates since this impacts the market price of debt securities. Debt funds have the potential to offer moderate and steady returns keeping capital protection as the key aim. Equity funds tend to carry a higher risk but also have the potential to offer higher returns than debt funds. As an example, over 10 years between June ’09 and June ’19, the debt funds category gave an overall return of 7.29%, while the equity funds category returned 13.53%.[i]

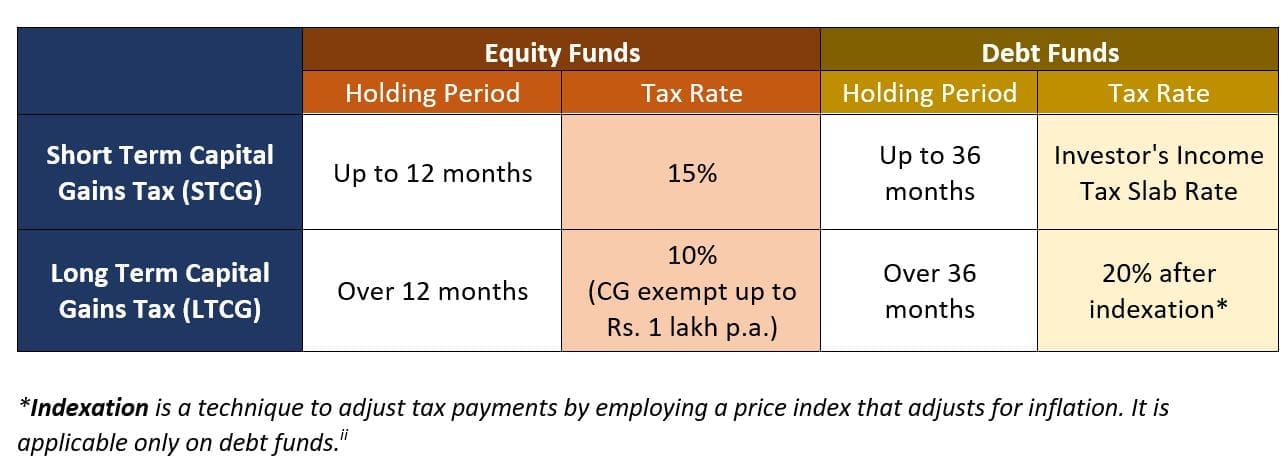

- Tax Liability: Capital gains earned on equity and debt funds are taxed differently. The rate of tax is lower for longer holding periods.

While the decision to choose between debt funds and equity funds seems challenging, it all comes down to your financial goals, risk profile, and asset allocation. While debt funds are suitable for regular income and capital protection, equity funds are best suited for long term wealth building.

Be the first to comment