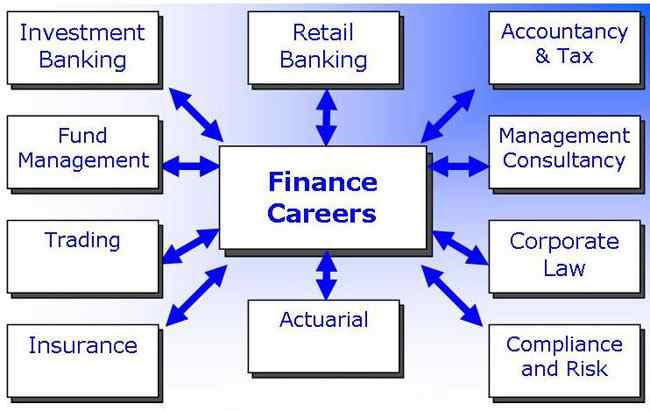

Finance is quite a broad term from career point of view. Statistics reveal that around 75% students opted for careers in finance lured by the fantastic pay. Most students have no idea about what career in financé entails and are simply swayed by the fact that a career in financé is paid the most. Here is an attempt at simplifying and presenting aspirants with some of the best financial careers that they could consider, while contemplating a financial career.

Financial Risk Management

Financial risk management actually involves creating economic value by utilizing financial instruments for managing exposure to risk, especially credit risk as well as market risk. Financial risk management needs to identify its sources, measure it, and plan meticulously about addressing them. Financial risk management could be both qualitative as well as quantitative.

Financial risk management is a specialization of the broader concept called Risk Management and it primarily concentrates on ways to implement financial instruments for managing exposures to all sorts of risk including credit, operational and market risks.

Corporate Banking

Corporate banking encompasses a host of banking services needed by corporate houses. Corporate may be divided into two main sections namely MSME (Medium and Small Enterprises) and large corporate. A corporate banker typically would have to serve companies as his clients. Corporate banking has many departments within it.

- Credit borrowing to businesses to fulfill their working capital needs and expansion plans. The job involves credit assessment on the company in question and afterwards, sanctioning the loan.

- Cash management solutions are offered by banks to its corporate clients. Majority of the firms’ boast of a large number of clients, branch offices and distributors across the nation and it increasingly becomes a major challenge to deal effectively in money. Banks help by streamlining this operation for its corporate clients.

- Treasury help firms manage a host of risks including interest rate and foreign exchange fluctuations. Treasuries are instrumental in helping companies in making profit in the bond markets or forex.

Retail Banking

This is referred to as consumer banking as well and entails dealing with services and products for each client. So the job involves acquiring business for products like savings account, credit cards, auto loans and personal loans. Operational roles would encompass teller, authorizing, remittances, clearing and customer service.

Corporate Finance

A corporate finance job entails working for a company to assist in finding money for running the business, growing the business, making acquisitions, planning financial future and managing whatever cash on hand is available. You could be employed in a large multinational organization or a relatively smaller firm with bright growth possibilities.

Corporate finance professional needs to create value for a firm. He is typically responsible for four major activities for fulfilling company objectives. They are: a) design, implement and monitor financial policies, b) plan as well as execute the financial program, c) manage cash resources, and d) interface with investors and financial community.

Corporate finance jobs are considered to be relatively much stable. Performance is definitely important, but your job does not solely depend on if you could sell enough this week or if you could get ample good deals this quarter. This is relatively a stable and secure job. You are expected to work with the sole aim of making your organization successful in the long run. Most experts are of the opinion that corporate finance positions are the best and most aspired for in the field of finance. Here are some advantages of being in the corporate finance sector:

- It involves team work so helps you in learning to work effectively with people.

- It is pretty challenging and great fun to handle business issues that really matter.

- It gives you ample opportunities to travel as well as mingle with people.

- It gives you a very good pay package.

Author Bio: Peter Brown is a career counselor and is in the business of advising aspiring candidates on taking up a career as per one’s aptitude, for decades. He has recently started blogging and is enjoying it immensely. He enjoys browsing through sites like http://pymntadvisors.com to keep abreast with the latest.

Be the first to comment