When you plan out how you want to manage your finances, you will almost certainly have to manage a chequing account at some point. A chequing account is more flexible than a savings account since you can write cheques and use a debit card or credit card, but they can also come with downsides that don’t make sense to deal with in some situations. If you need to go over the details of owning a chequing account, here are some of the highlights.

1. Overdraft Protection

People usually use chequing accounts because they want to be able to use credit, debit, or write cheques, but if you accidentally try to spend more money than what exists in your chequing account there can be trouble. Overdraft protection can help you stay on top of your financial obligations in the event of a mistake or financial shortfall by allowing cheques to clear even when you might not have money in your bank account.

Keep in mind that this isn’t free money. Not only will you have to pay an overdraft fee, but you will also need to make sure your account is connected to a secondary line of credit like a credit card or savings account. If you don’t have overdraft protection, the transaction will be declined and you will usually be charged an additional fee as well. Whether or not you want to opt in to overdraft protection is up to you, but it is always a good idea to have a backup plan.

2. Minimum Requirements

You might have to meet a few requirements each month to keep your chequing account open depending on where or why you open it. The best chequing account in Canada or the U.S. might not have a monthly fee, but many financial institutions will usually require an account holder to make a certain number of transactions each month, have a minimum balance requirement, or otherwise include some kind of monthly maintenance fee.

There might be a few ways to reduce or eliminate these fees, like with a student or business account, but usually, if you want to have a chequing account you need to make sure it is being actively used. Additionally, there are often minimum balance requirements associated with bank accounts and this is definitely something you need to adjust for when spending money in a U.S.-based Canadian bank account.

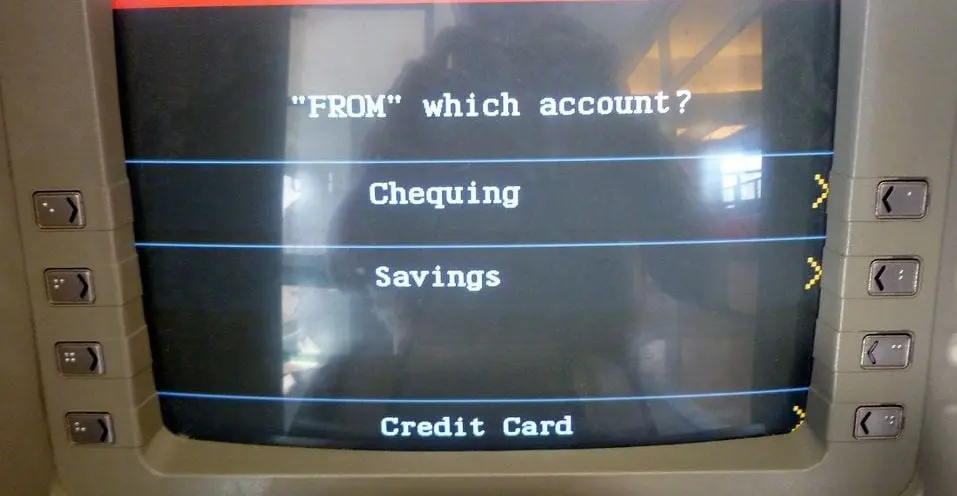

3. Debit vs. Credit

Credit cards, essentially, represent a standing line of credit that you can use to take out a loan on the spot and don’t immediately represent the removal of funds from your bank account. Proper and consistent payment of credit card bills is also a factor that is considered when calculating a credit score, so if that is something you want to build you should use a credit card. If you want to buy short sleeve womens dresses, rompers, jackets, or other clothing items but don’t have the cash, or you want to build your credit score, you would use a card if you know for a fact that you can pay it off later.

Debit cards, on the other hand, give you the ability to use your bank account immediately where and when you need it. This is the best option for some since it’s cheaper in the long run and you don’t have to pay interest on credit card loans that might span months or years in addition to removing the temptation to buy things you might not necessarily be able to pay for.

Money management is a useful skill, but it isn’t something that everyone is taught. Dealing with all of the paperwork that goes into working with major banks to get loans, bank accounts, and all of the offers and features associated with them isn’t always straightforward. As long as you do your best to make good budgeting decisions, you should be just fine.

Be the first to comment