I knew I was in trouble the day my bank account hit zero.

I’d watched its slow decline for weeks, so I knew it was coming. Graduation had caused my savings to take a big hit, and my post-grad move to Florida depleted everything I had left. The worst part was that I couldn’t even claim to be a poor college student — now, I was just poor. After spending the summer counting my pennies, never having more than $100 to my name at any given time, I learned a few things.

There are things of greater value than money.

Three of my best friends married over the summer, and forking out for plane tickets and gifts took up most of my weekly paychecks. It was worth it, though. I knew I would rather have the memories than the money.

You don’t need to eat nearly as much as you think you do.

I learned to make a box of pasta last a week and that you can make four sandwiches with a can of tuna fish. We’re used to big portion sizes in the United States, but the truth is your body does just fine with a bit less, and you’ll be surprised how much money you can save by simply cutting your portion sizes.

Nature is the best gym you’ll ever find.

I was always the queen of gym memberships, but there was no way I could afford one once I got to Florida. Instead, I started running outside, and I liked it.

There’s an app for everything (and it’s usually free!).

Since I missed my gym membership, I found a free app that created personalized workout routines. Whatever you need, chances are there’s a free app for it.

Free resources are everywhere.

From public transportation to public events, take advantage of everything available. Love to read? Get a library card.

Ultimately, you are in control of your finances.

The hardest thing I had to do over the summer was learn to say no to evenings out, fast food runs, and anything else I didn’t have the money for. You control your spending. If you can’t afford it, learn to accept that.

There are always ways to make money.

Always. Do your neighbors need their dogs watched? Children babysat? These might not be the most glamorous things in the world, but they’re ways to make quick cash if you’re desperate.

Reward points, reward points, reward points.

Not only did my workout app have a rewards system that I could redeem for gift cards, but the credit card I eventually got did, too. My daily exercise routine was earning me free groceries.

Creativity is king.

Especially when it comes to budgeting. Think outside the box to do more with less, repurpose items, or discover new ways to save.

Sometimes, you have to re-evaluate your life plan.

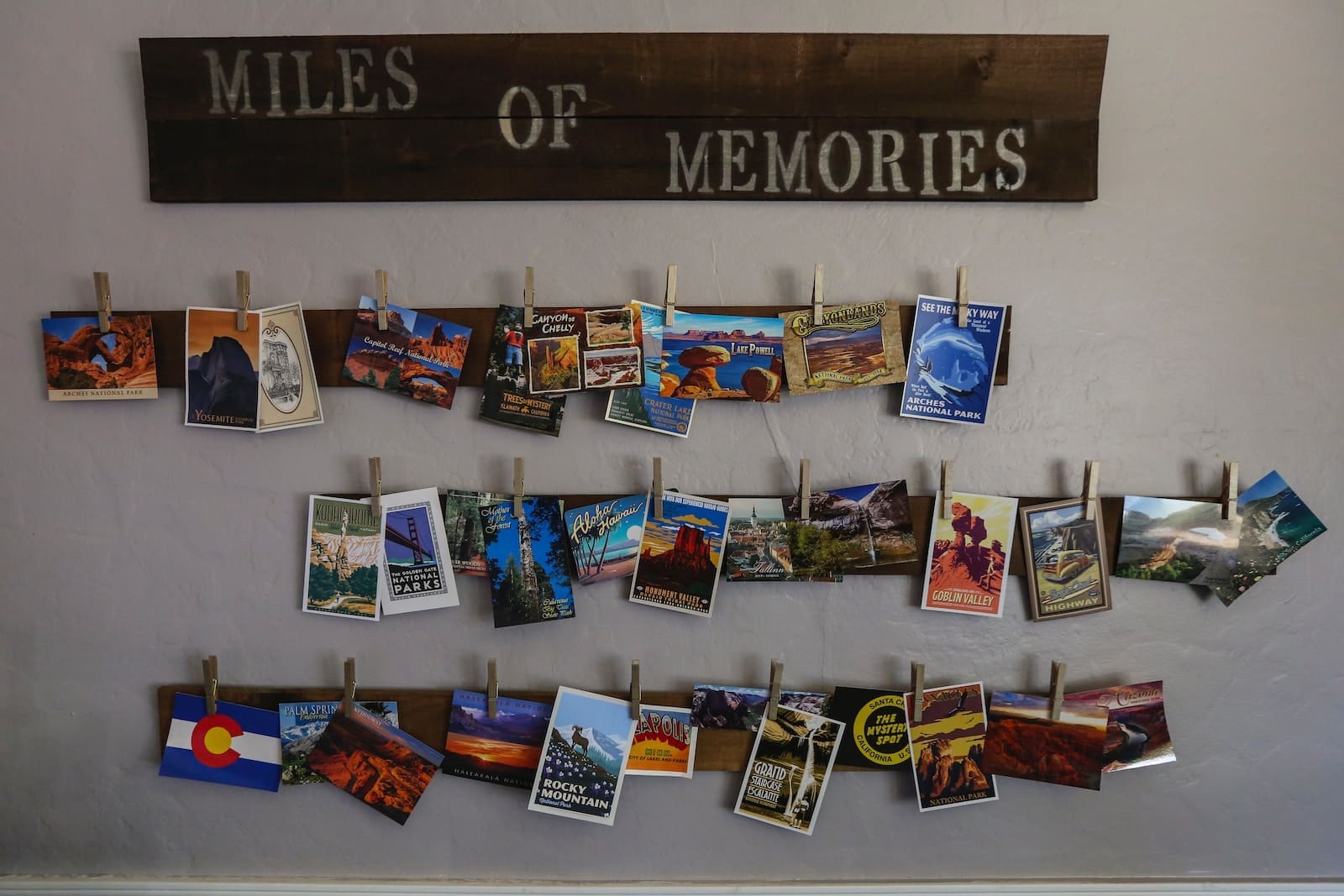

All I wanted to do after college was travel. I had these great romantic visions of me wandering the world with nothing but a backpack and a camera. I didn’t think I would ever get a full-time job or use my degree. After three months of making minimum wage and struggling to make ends meet, nothing seemed more appealing than a full-time job and a steady salary.

I realized that if I couldn’t even afford groceries, there was no way I was spending the summer in Greece. A month later, I found a full-time, virtual position that paid an excellent salary and allowed me to work from home. Goodbye, financial stress. Hello, travel.

With some resourcefulness and determination, you can succeed living on a tight budget.

Be the first to comment