Because of financial limitations, several people take out loans. The most popular forms of loans are eligible in cases such as purchasing a new automobile or home (car loan or home loan), studying overseas (student loan), consolidating current debt, taking a family holiday (holiday loan), covering medical expenses and much more.

In the United Kingdom, loans UK are offered in various forms. Check all the options (interest rates, repayment period, etc.) before selecting a loan provider and then decide who to go with.

Types Of Loans Available

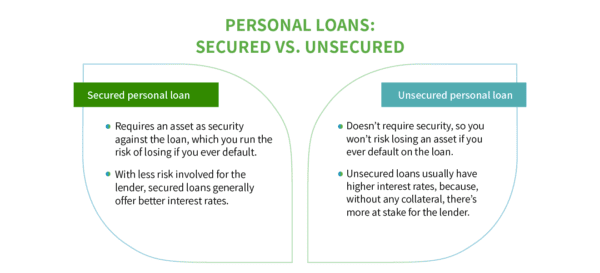

Loans UK are mainly classified into two categories, secured and unsecured loans

Secured Loans

Such loans use a commodity as leverage, such as your home or car, meaning you could forfeit the asset if you can’t cope with repayments. But if you are sure you can adhere to the payment plan, a secured loan can still be fitting. Collateral eliminates lender risk, and you can get cheaper rates or higher sums with a secured loan, even if your credit score is poor.

Listed below are some of the different forms of secured loans UK

- Homeowner loans

- Vehicle loans

- Logbook loans

- Bridging loans

Unsecured Loans

Personal loans require very small sums to be borrowed, e.g. £ 1,000, but they can go considerably higher. Often people use it to spread the expense of a big spending. You would not have to use an asset as leverage (such as your property) which means reduced risk for you. You’re definitely going to need a high credit score though, to get a good interest rate.

Listed here are some of the different types of unsecured loans UK

- Bad credit loans

- Guarantor loans

- Personal loans

- Peer-to-peer loans

- Business loans

Some other types of loans UK are

Guarantor Loans

These loans allow you to have one guarantor. If you can’t, anyone who agrees to repay the loan. This is generally an older relative or friend, but it can be almost anyone who fulfills the requirements of the lender. These loans hold both the guarantor and the borrower at risk, but using a guarantor will increase your chances of approval if you have a bad credit rating.

Car Finance Loans

You can finance a car in many ways, whether you want to purchase it outright, pay for it in installments, or even rent it out. Each alternative has various benefits and drawbacks so there’s a lot to think about before you apply.

Procedure For The Application Of Loans

The authorization process can be done out online while applying for loans UK. Most lenders allow borrowers to upload the documents required when submitting their application.

Getting The Application And Submitting It

The loan servicer will review the submitted details and conduct a credit check on the borrower to decide whether to accept the loan or not.

Background Check

The loan servicer must review the details for any inconsistencies which will decide the status of the loan approval.

Quoting

The loan servicer will give you an estimation of their best deal when taking out loans UK. That’s after he has finished the background check.

Final Quote

If the borrower follows the requirements of the lending companies, a final offer is made. When loans are finally offered, the borrower can either choose to accept or reject the bid.

What Affects Your Credit Scores?

There are several circumstances that can have a negative effect on your credit score in the UK. Below are some of the most common explanations.

Frequently Applying For Loans

When you have applied repeatedly in a short period of time for a loan it will impact your credit score. Loan services may see you as highly credit-dependent and can avoid giving you loans because you present a high risk.

Going Bankrupt

When you file for bankruptcy your credit score will be greatly affected. Depending on which form of bankruptcy you file it will show on your credit history. Bankruptcy should be viewed as the last resort, as your credit score will be severely affected and your loan applications will not be accepted by providers.

Late Payments

All providers of loans view late payments as a sign of financial problems. Lenders will assess you if you struggle to keep up with spending. Late payments can have a negative effect on your credit score, which can lead to increased interest rates.

What Are The Documents Needed?

Loan companies review the candidate’s Credit Rating Agencies (CRA) credit score. Loan services will however also allow borrowers to provide tangible forms of the documentation listed below. Loan services often allow borrowers to have 2 identification forms. One for address proof, and the other for identity proof. CRAs often allow the applicant to measure the credit score by some specifics.

Documents For CRA

- Details of bank account

- Personal details

- Previous address proof if he has moved in the last 36 months

- Previous employment details

Address Proof

- Driving license

- Recent bills

- Bank statements taken out recently

- HMRC tax notification

Loan Providers ID Proof

- Valid driving license

- Passport

- Biometric residence permit

Bear in mind that your credit score will suit the credit requirements needed when making use of loans UK. If you have a poor credit score, you’ll draw lenders that offer high interest-rate loans that can turn to debt.

2 Trackbacks / Pingbacks