Having a trading exit strategy is critical to avoid massive financial loss. For the first time in history, high technology gives us the opportunity to design this tool to calculate and optimize numerous exit strategies.

Traders Paradise’s ultimate tool for traders is currently the only way to optimize your exit strategies.

How does it work? Well, it’s extremely easy and user-friendly. This app is suitable not only for the elite traders out there but also (and mainly) for new traders.

What is the difference between an elite trader and a newbie?

That’s simple: According to our researches, 85% of the traders claim to have lost more than gained with their tradings. This means only 15% of the traders succeed to gain. But it’s not a balanced gain, they gain all 85% losing traders’ money since the stock market is a zero-sum game (means someone has to lose for you to gain).

So we started to investigate.

Trading-wise, what are they doing differently? What difference between a newbie and a successful trader? The answer overwhelmed us.

Most of the traders, the newbies, started positions with no exit strategy! You might think, well, who cares about an exit strategy? The enter strategy is the most important. Wrong! In any trade, there’s only one thing that interests you – the exit strategy. Why?

When you buy stocks / start a position, you truly believe the price to move towards the direction of your position (otherwise, you wouldn’t enter this position), but what happens if 10 seconds after you enter your position, and the price shifting the other direction? What will you do?

We studied the stock market data for years.

What we can say for 100% sure is:

The stock market is extremely efficient, yet volatile. Nothing, not a single thing, is sure. Never.

So you must have an exit strategy prepared for every single trade you make. You must define your risk management method, and you cannot, under any circumstances, design it according to intuition. Even if you believe you have strong intuitions and you’re almost close to being a mentalist, you have to have a good solid exit strategy planned, in order to overcome loses.

What is a good exit strategy for trades?

A good exit strategy is based on Stop Loss / Take Profit method. Take profit is where you want to close a position in profit, and you wish to do it at the top prices before it drops back down and stop-loss is when your trade just shifted direction and starting to lose, so you want to minimize your loss as much as possible.

Until now, more than 25 years after the stock-market became digital, there wasn’t any way to calculate and optimize your stop loss / take profit strategy. Don’t believe me? Google it. They all talk about “usually you put these strategies at 30% profit, and 15% loss” or other random numbers like that.

But we want accuracy! This is our funds we’re talking about.

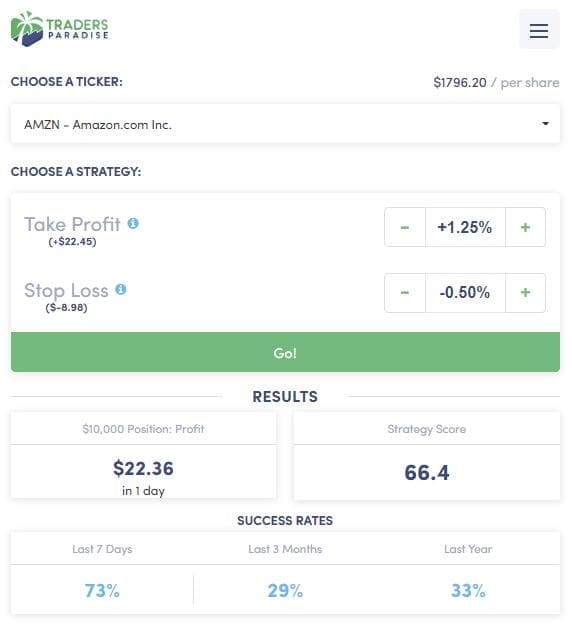

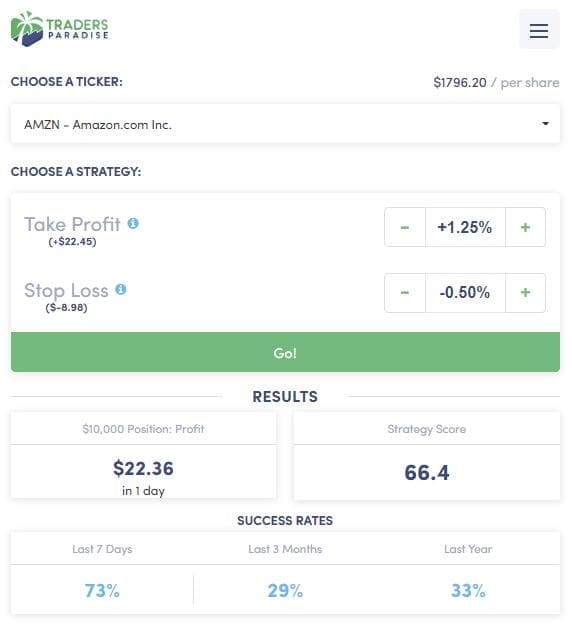

So Traders-Paradise designed this simple tool. In less than 10 seconds you’ll see how good any strategy is. All the data is valid and 100% accurate. There is no improvisation, no partly information. All data come from an official market data supplier to Traders-Paradise’s servers, and then mathematically manipulated to exit strategies.

Why trading exit strategy is so important?

Financial markets will never move in one direction endlessly. Their ups and downs are caused by news and events, by algo-traders and speculations, and many more players with various agendas. Traders who allow their profits just run can eventually catch important losses. To avoid them, it is important to exit trades at the best time.

If you set a well-designed trading exit strategy, you will lock in profits and cap losses. Moreover, you will avoid any emotional impact on your decisions.

Let’s assume you are a loss-averse trader. And the price of your stock is going down. If you hold your position with hope the price will change direction, you might miss an exit solution while you are losing.

On the other hand, you may feel fears from the reversal and get out of a successful trade early. This app will help you leave the trade timely.

The app is based on Stop-loss and take-profit levels

Trading exit strategy requires setting stop-loss and take-profit orders to exit.

You need a stop-loss order to determine the precise price of the stock at which you will close the losing position.

When the stop-loss is triggered, it automatically becomes a market order and minimizes losses if the price goes against you.

Take-profit will help you to define the precise price at which to close a successful position. Also, a take-profit turns into a market order when set and triggered.

When you set stop-loss and take-profit orders you have to be sure that you left enough space for the price to fluctuate. So, be reasonable while doing that. Never place these orders too close because they can be triggered too early.

Risk tolerance is your strength to manage a loss.

A stop-loss controls your position and provides you not to have losses. You are protected against downside risk. Moreover, a stop-loss can be set when the price of a stock goes up and you are lock-in profits. This app provides you harmony and peace of mind that your winner will never convert to a loser.

How Traders Paradise app works

It uses historical data and it runs (very very fast. For a human-being, with endless resources it will take years and thousands of Excel sheets to do what this app does in just a few seconds) and open many positions to see how they are closed, profit or loss, the average time and many more information. This happens numerous times, to assure the results are accurate.

The results will show you how well this strategy was in the last 7 days, the last month and the last year, you can see the average position time, and you can see, on average, how much money you can gain (or lose) if you’d make a 10,000USD position.

This app is molding the future of stock trading. Using it you can analyze billions of data-sets and execute trades with greater accuracy. Also, you can efficiently decrease risk to provide for higher returns.

1 Trackback / Pingback