An Introduction to Managed Forex Account

A managed forex account is a type of Forex account in which a money manager trades the clients’ account for a mutually agreed fee between client and money manager. Managed forex accounts can be considered similar to hiring a traditional investment advisor to manage an investment account of bonds and equities.

How do Managed Forex Accounts Help Clients?

The intricate trends of the Forex market often confuse the beginning traders making them wonder ‘is forex worth it?’. The processes like data manipulation and analysis, contradicting signals, brokers, trading styles, buying, and selling need a professional caretaker. Managing forex accounts is difficult for investors (Client), so investors usually hire a money manager to manage their forex accounts. An experienced money manager can trade clients’ funds for a salary or a fixed share of the profits.

Advantages with Managed Forex Accounts

There are many benefits of opening a managed forex account. Still, the most crucial advantage is that your funds are not directly controlled by the forex money manager, but these are held by the forex broker. So, the money manager can only trade your account and cannot withdraw any funds from your account.

A professional money manager can better take care of your account; because he has an excellent knowledge of forex market trends, methods to reduce risks or even refute the significant risks associated with currency trading. In addition, a money manager devotes his energies to trading, so you have a high possibility of making a profit in either a rising or declining market.

A professional has 24/7 access to trade and knows how to tackle the liquidity of the forex market. This 24/7 access to trade helps money managers make more profit and allows them to avail benefits of market liquidity.

Money managers who manage managed forex accounts offer a clear and transparent reporting system. So, you can have a quick and no-efforts reporting when and where you want.

Money managers run Forex-managed accounts on fixed share or fees. That is another benefit of the accounts, where the client does not have to make any efforts to make a profit; a money manager does this for him and charges his fee only. However, fixed share and fees between managed accounts can vary greatly; therefore, one has to research thoroughly before assigning an account to a professional.

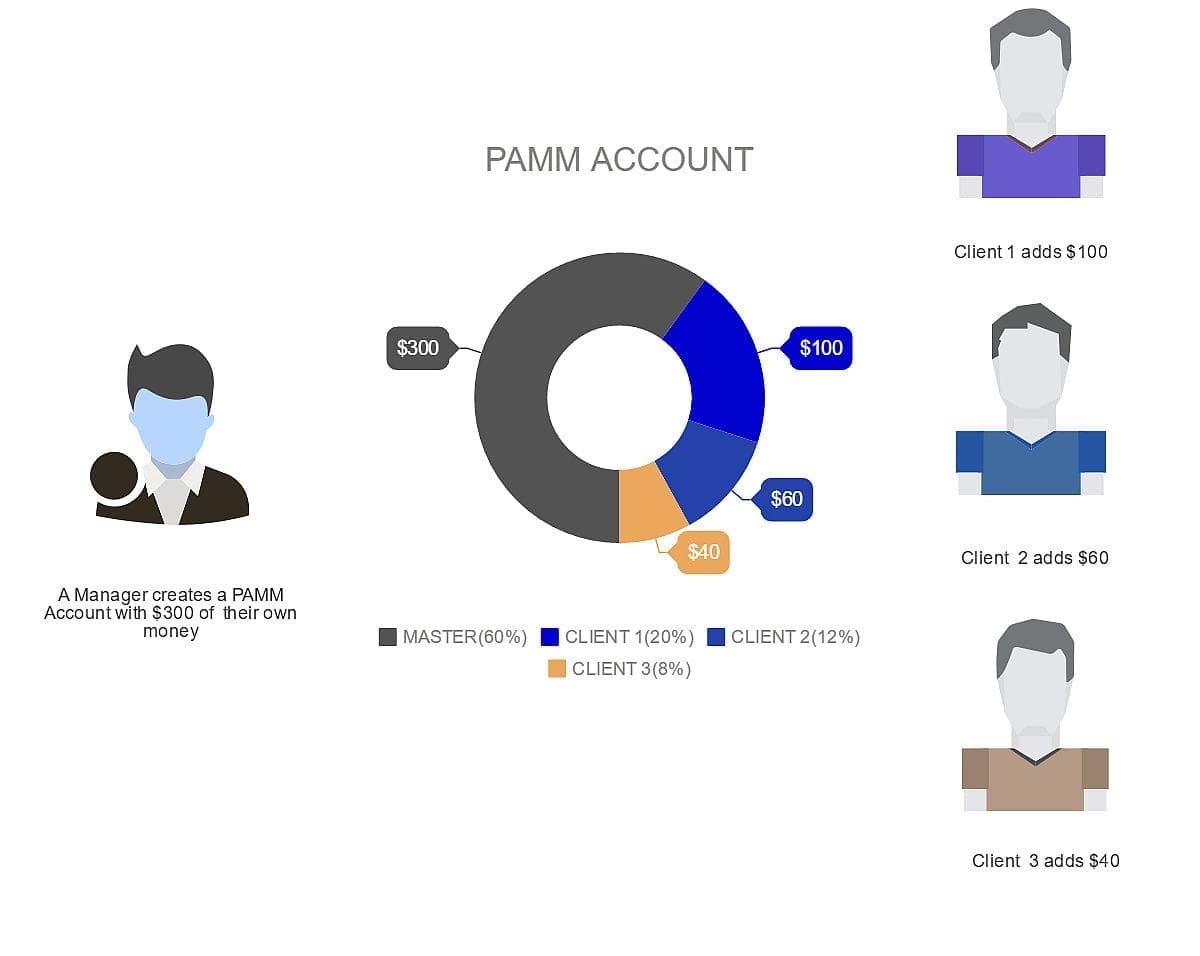

What is a PAMM Account?

PAMM (Percentage Allocation Management Module or Percentage Allocation Money Management) is a famous Forex broker extension. It allows money managers to manage clients’ money. In addition, the module secures the relations between Investors, Money Managers, and the Broker.

How Does PAMM Account work?

PAMM account is a trading account managed by a money manager and consisting of one or several managed forex accounts of clients. It represents a separate single trade structure in which the money manager can carry out trade activities only. Therefore, the trading platform considers several managed clients’ accounts located within a single PAMM account as one unit. The basic principle of PAMM account working shows its proportional distribution of profits and losses among the investors’ accounts.

PAMM Account investors are usually unfamiliar with Forex. It provides them an opportunity to access the potential profitability of Forex markets without any knowledge of the forex market. The PAMM Account Manager is responsible for all trading (loss and profit) around the PAMM Account and receives a performance fee as compensation.

What can be the investment benefits of opening a PAMM Account?

A PAMM account is beneficial for investors; because of

- The chances to earn money without transactions on their own accounts

- The system of PAMM-accounts is safe to invest money under the care-taking of a reputable broker

- The investor can have access to the manager’s PAMM-account monitoring.

- Invest the minimum amount of money in PAMM Account

- An investor can diversify risks by making investments into various accounts

- Reinvest into the same PAMM accounts to get more profit from the same account, as the number of assets is not limited.

- Give only mutually agreed fee to the Account manager

- Definite protection from draw-down by the PAMM manager

- Some brokers give an option of stop loss to the investors to save money

In the end, I would like to summarize the reasons to choose Forex managed accounts

1. High net worth investments available to the middle class

2. Ability to Achieve Profit or Loss in Rising or Declining Markets

3. Risk Control

4. Risk Diversification

5. Greater Leverage

6. Reduce portfolio risk while enhancing returns

7. Global Diversification

8. Transparency in operation

9. Low Correlation

10. No Independent Market Controllers

11. 24 Hours Trading

12. On-time reporting

13. Professional managed account service

14. Dedicated money manager

15. High return on investment

16. Fixed charges/fees for providing managed forex services

Be the first to comment