There was a time when investors did not have many investment payment options. Generally, you would have to pay your investment amount at the beginning of the investment cycle. Another option was to pay the premium once every year until the maturity period. Such investment options were not of much help for an investor, especially in case of mutual funds. That’s because investors would receive units all at once, depending on the fund’s NAV, and they would have to rely on the market for these units to increase.

However, ever since the introduction of SIP, things have become a lot better for investors. SIP investment is a systematic approach where investors can continue investing every month. This systematic payment approach means investors are allotted units every month, depending on the NAV of the fund.

For those who do not know, Systematic Investment Plan or SIP is a systematic approach where investors instruct their bank to deduct a fixed amount every month on a predetermined day, and this amount is electronically transferred to their mutual fund. While calculating returns of a lump sum payment might be easier, calculating SIP returns need might not be that easy.

So if you too have invested in SIP and wondering what potential returns you shall seek at the end of the investment tenure, here are five simple steps to calculate your SIP returns:

-

STEP 1 to calculate SIP returns

The first thing to do is open Excel in your laptop or smartphone. The next thing to do is list down all your SIPs in one column. In case you have started your SIPs from December 2017, on your payments on the 10th of every month, mention all the months in one column one after the other starting from Dec 17 till the month you want to see the SIPs potential gains.

-

STEP 2 to calculate SIP returns

Once you’ve added all the months, the next thing to do is add your SIP amount next to the months. For example, if you have invested 10,000 per month, you need to enter the amount as 10,000, prefixing it with a minus sign.

| SIP Date | Investment Amount |

| December 2017 | -10000 |

| January 2018 | -10000 |

| February 2018 | -10000 |

The reason we prefix a minus sign with the SIP amount is because we are showcasing the outflow of cash every month.

-

STEP 3 to calculate SIP returns

Now enter the accumulative market value of all your units. Say you want to check the potential returns from SIP investments on a particular date, type the date and the current value of all your mutual fund in the same columns where you have entered details of the SIP date and amount. Remember to not prefix a minus sign next to the market value of your mutual fund units. That’s because you are now calculating the potential inflow of cash that you are bound to receive when you withdraw your funds.

| SIP Date | Investment Amount | NAV (Net Asset Value) |

| December 2017 | -10000 | 40.24 |

| January 2018 | -10000 | 43.56 |

| February 2018 | -10000 | 41.73 |

| March 2018 | 30000 |

-

STEP 4 to calculate SIP returns

Now move your cursor to a blank cell and start XIRR function. Under XIRR there are three parameters – Values, Dates and Guess. For Values, select the cells with SIP amount and unit value. For Dates, select the cells with SIP dates and the date at which you are calculating the potential returns (in case of our example, August 2018). Leave the Guess option blank and click OK.

-

STEP 5 to calculate SIP returns

The final step is to multiply the decimal number by 100. The will result in a figure indicating the return you have earned on your SIP investments on the date of your choice (August 2018).

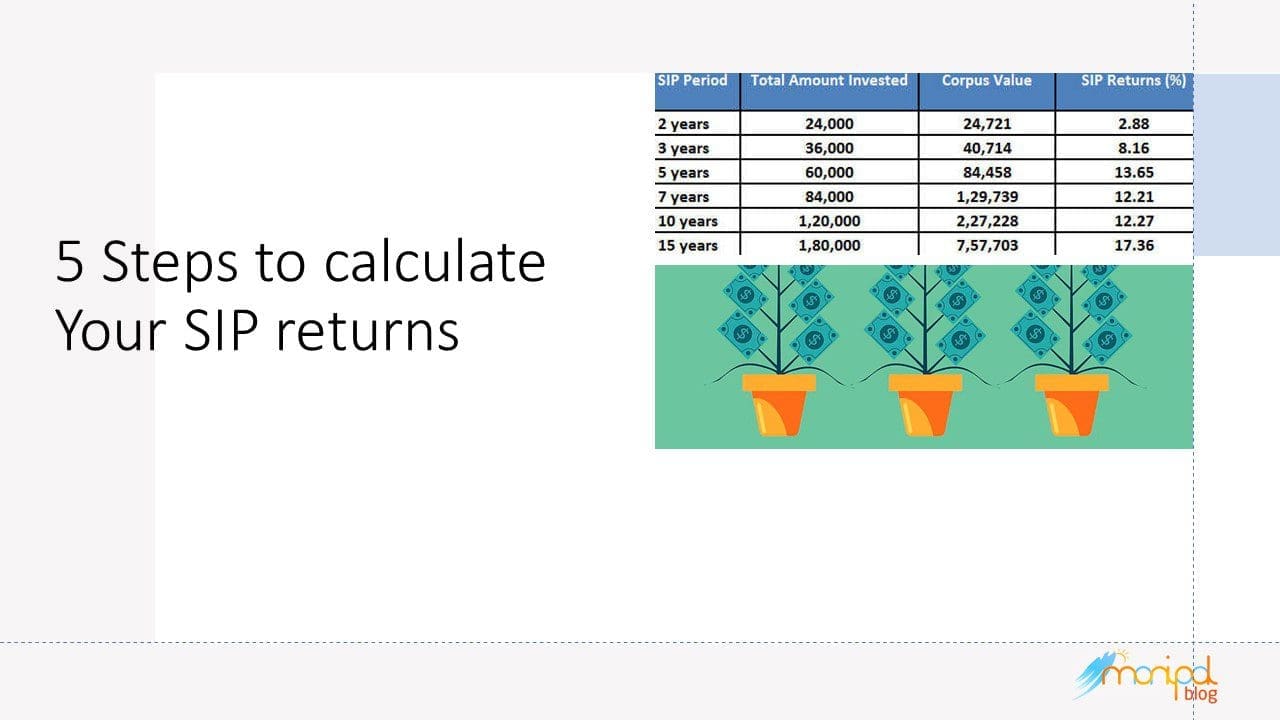

You can either use these five simple steps to check your SIP returns or check the returns on an online SIP calculator. This is an optimum way to check your SIP returns, especially if you do not have access to Excel or find it difficult to check the returns manually. Online SIP calculator is an easy process. All you need to do in insert your SIP amount, the number of years to wish carry on the SIP for, and the interest rate you think the fund has potential to offer you over the years. This way, the calculator will show you an approximate value that your SIP might help you fetch if you remain invested in your SIP.

It is better if you hold your SIP investments for a long period of time. This way you will not only benefit from the power of compounding but also increase your chances of building a decent corpus in the long run.

1 Trackback / Pingback