COVID-19 has created havoc in the economy. Every sector has been affected by this change, from insurance and automotive industries to food and beverage companies. The current pandemic has resulted in the shutting down of companies, job losses and pay cuts, not to mention an increase in the burden of insurance premium payments.

To survive the financial burden, many people are considering loans. With restricted monetary capacities, your best bet is to avail interest free loans during the pandemic.

Interest-free loans, also known as 0% loans, only require you to make the principal payments towards your loan every month. As long as you pay them on time, you can avoid any late fees or added costs. If you want to clean up your credit score then visit bad credit help now!

Why Get Interest-Free Loans?

Survival During The Pandemic

Some people have lost their jobs due to the global coronavirus situation. If you need funds to keep your head above water, you can explore the various interest-free loans given out through pandemic emergency schemes and assistance programs.

Use this money to meet your short-term financial needs like protective equipment, food, rent, phone bills, and other commodities needed to survive the pandemic. Not that the payday loan stays free of interest for a fixed period, after which you will have to pay the interest.

Debt Repayment

Given the current state of affairs, many people in the UK are unable to keep up with their debt payments. For those whose debt repayment capacities are filled to the brim, an interest-free loan can provide temporary relief.

Because of the economic downturn, many banks and financial aid organisations are willing to give out 0% loans. Thus, it is advisable to use this time wisely and pay off any high-interest debts.

Better Than High-Interest Loans

High-interest loans erode your savings and are not a good idea during an epidemic. Interest-free loans are a stopgap measure that will allow you to pay your dues as well as set aside funds for medical emergencies and purchasing essentials.

How To Avail Interest-Free Loans?

The privilege of interest-free loans cannot be enjoyed by all. Interest-free loans can be your saviour when a financial crunch kicks in. However, you have to start preparing yourself for these loans the day you start pocketing your income.

You can get an interest-free loan using your credit cards and bank overdrafts. Experiment with different types of loans such as secured and unsecured debts. Discuss your options with your lender and pick one which would suit your financial appetite.

Talk to different lenders. Keep an eye on all lenders for any reduction in complications and make comparisons. Moreover, consider your credit score as it will be easier to access these loans with a robust history.

How Does Your Credit Score Decide Your Loan Interest Rates?

Credit scores play the most important role when it comes to interest-free loans. Loans are given out by banks who take the financial risks and give out money to people. This risk increases in case of unsecured loans.

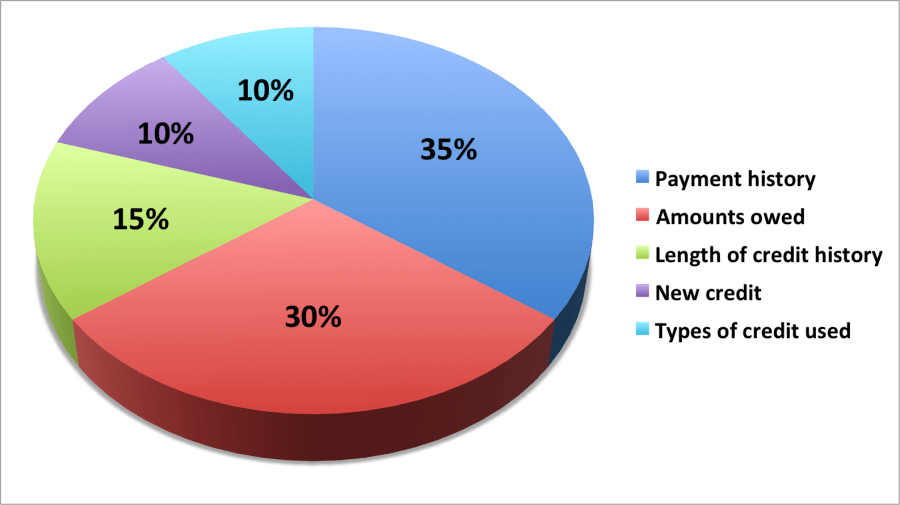

Credit scores come in handy for these lenders and banks to assess the financial health of an individual. Moreover, your credit score tells your bank about your repayment capabilities and how likely are you to fall into debt. Therefore, to get 0% or low-interest loans, you should maintain a healthy credit score.

A decent credit score in the UK is anything above 630. If your score is above 700, no one can stop you from getting a loan. Since the criteria vary from lender to lender, you can contact your financier to know more about any other specific loan availing terms and conditions.

What Impacts Your Credit Score?

Due to the efficiency of credit cards, people are now wired to swipe their cards for every payment. On the other hand, paying off the debts after incurring a heavy bill doesn’t come quite so easy. Any delays in or non-payment towards your debts and interests can majorly impact your score.

You can follow these tips to improve your credit score:

- Start with paying off your debts which have a high APR.

- Put a stop to availing unsecured loans.

- Use a credit card for bad credit uk to build your score.

- Consolidate all your debts and start paying off the debts based on their proportion in your total debt structure.

- Look into an auto-debit feature if you tend to miss your card payments.

- You can take some professional help or join Debtors Anonymous groups if you are a compulsive debtor.

Types Of Interest-Free Loans

Compare different 0% loan options from different lenders to make the best choice. Also, it is wise to note the rate applicable to these loans after the interest-free period is over.

Here are a few 0% loan options you can consider:

Interest-Free Overdrafts

If your bank has provided you with the facility of 0% interest overdraft facility, now is the time you use it. Your credit score will determine the size of the loan.

Purchase Credit Cards With 0% Interest Rate

You can avail this option if you want to make a single large purchase such as an appliance, mobile, etc. You can make use of this loan for up to 2 years, after which you will be charged with a high-interest rate.

A 0% Balance Transfer Credit Card

This card can be used to pay off all your credit card dues. You can convert your credit card debt to an interest-free loan and use its services for up to 30 months. This card comes with a pre-decided limit.

Conclusion

It is better to collect all the pertinent information before applying for a 0% interest loan. At times, the high-interest rates can negate your savings, and you might have to pay even more. With proper research, you can narrow down your options and pick the one most suited to your needs.

A good credit score would make it easy for you to choose from different interest-free loans. With these loans, you can fund your needs during a pandemic without any burden.

Be the first to comment